You might be surprised to learn that Utah’s no-fault insurance system, while intended to simplify claims, can actually increase the cost of car insurance for many drivers. This is because it requires individuals to rely on their own Personal Injury Protection (PIP) coverage, even if they weren’t at fault in an accident. This means drivers pay for their own medical expenses and lost wages, regardless of who caused the accident. While this system aims to streamline the claims process, it can lead to higher insurance premiums as drivers need to cover their own costs. For example, if you’re involved in an accident where the other driver is at fault, you’ll still need to use your PIP coverage to cover your medical expenses. This can lead to higher premiums, as you’re essentially paying for coverage you may not need in every scenario.

Toc

- 1. Deciphering Utahs Minimum Coverage Requirements

- 2. Uncovering the Best Car Insurance Options in Utah

- 3. Related articles 01:

- 4. Factors Influencing Utah Car Insurance Rates

- 5. Navigating the Impact of Your Choices on Your Premiums

- 6. Frequently Asked Questions

- 7. Related articles 02:

- 8. Comparing Car Insurance Options in Utah

- 9. Conclusion

Finding affordable coverage can feel overwhelming, especially with a myriad of options available. But don’t fret! This guide will help you navigate the intricate world of car insurance in Utah, ensuring you find the best deals while meeting your coverage needs. This guide will help you find the best car insurance in Utah, ensuring you get the coverage you need at the best price.

Deciphering Utahs Minimum Coverage Requirements

Before diving into the top insurance providers, it’s crucial to familiarize yourself with the minimum car insurance requirements in Utah. The state mandates the following coverage:

- Bodily Injury Liability (BIL) Coverage: $25,000 per person and $65,000 per accident

- Property Damage Liability (PDL) Coverage: $15,000 per accident

- Personal Injury Protection (PIP) Coverage: $3,000 per person

While Uninsured/Underinsured Motorist (UM/UIM) coverage is optional, it’s highly recommended to protect yourself in case of an accident with a driver who has insufficient or no insurance. Driving without the required minimum car insurance in Utah can lead to serious consequences, including fines, license suspension, and vehicle registration cancellation.

Understanding these requirements is essential to avoid potential legal issues and financial burdens. By ensuring you have adequate coverage, you can drive with peace of mind, knowing you’re protected against unexpected events.

Understanding the Costs of Coverage: A Closer Look at Minimum and Full Coverage

When considering car insurance, it’s essential to weigh the costs associated with both minimum and full coverage. Minimum coverage meets state requirements but may leave you vulnerable in the event of an accident. Full coverage, while more expensive, provides comprehensive protection against a broader range of incidents, including damage to your own vehicle and additional liability coverage.

Uncovering the Best Car Insurance Options in Utah

When it comes to finding the most affordable and comprehensive car insurance in Utah, several providers stand out. Here’s a closer look at some of the top options:

Nationwide: A Reliable Choice for Full Coverage

Nationwide offers an average monthly cost of $111 for full coverage car insurance in Utah, making it a budget-friendly option for drivers seeking robust protection. With a J.D. Power rating of 842 and an AM Best rating of A++, Nationwide is known for its reliable customer service and financial stability. They also provide a variety of discounts, including safe driver, multi-policy, and good student discounts, making it easier to save on premiums.

USAA: Exclusive Coverage for Military Members and Families

For Utah residents with a military connection, USAA is a standout option. Offering an average monthly cost of just $43 for minimum coverage, USAA provides exceptional value. However, this coverage is only available to active-duty military personnel, veterans, and their immediate families. USAA is renowned for its customer service, boasting a J.D. Power rating of 881, the highest in the industry. If you qualify, this is undoubtedly one of the best car insurance options in Utah.

Geico: A Cost-Effective Solution for Minimum Coverage

Geico shines in the minimum coverage category, with an average monthly cost of $53. This makes it a practical choice for drivers looking to meet the state’s basic requirements without breaking the bank. Geico’s A++ AM Best rating and 835 J.D. Power score also inspire confidence in its financial strength and customer service. Additionally, Geico offers a range of discounts, including those for safe driving, military service, and federal employees.

Auto-Owners Insurance: Competitive Rates Across the Board

Auto-Owners Insurance is a solid all-around option, with an average monthly cost of $141 for full coverage and $48 for minimum coverage. This provider’s A++ AM Best rating and 837 J.D. Power score indicate its commitment to delivering reliable service and financial protection. Auto-Owners also offers a variety of discounts, such as multi-policy discounts, which can further reduce your overall costs.

Progressive: Innovative Solutions for the Modern Driver

Progressive is known for its innovative approach to car insurance, including usage-based insurance options that can save you money based on your driving habits. With an average monthly cost of $108 for full coverage, it’s a competitive choice for drivers seeking flexibility and savings. Progressive’s Snapshot program allows you to track your driving behavior, potentially earning you discounts for safe driving. With an A+ AM Best rating, Progressive is also a financially stable choice.

2. https://kinemasterap.org/mmoga-best-auto-home-insurance-companies-save-money-simplify-coverage

3. https://kinemasterap.org/mmoga-the-best-jewelry-insurance-protecting-your-engagement-ring-and-more

4. https://kinemasterap.org/mmoga-finding-the-best-pet-insurance-colorado-a-guide-for-pet-owners

Factors Influencing Utah Car Insurance Rates

When shopping for car insurance in Utah, it’s important to understand the key factors that can impact your premiums. These include:

- Age and Driving Experience: Younger drivers, particularly those under 25, typically face higher rates due to their lack of experience behind the wheel. Insurers often view younger drivers as higher risk, as they are statistically more likely to be involved in accidents.

- Driving Record: A history of accidents, speeding tickets, or DUIs can significantly increase your insurance costs. A clean driving record is one of the best ways to secure lower rates.

- Credit Score: Utah is one of the states where your credit score can directly affect your car insurance rates. Insurers often use credit scores to gauge risk, so improving your credit can lead to lower premiums.

- Vehicle Type and Value: Higher-end or performance vehicles tend to be more expensive to insure than more practical, value-oriented models. If you drive a luxury car, expect to pay higher premiums.

- Location: Where you live in Utah can also play a role, as areas with higher accident rates or vehicle theft may see higher premiums. Urban areas often have higher rates than rural locations, with cities like Salt Lake City or Provo typically being more expensive to insure.

- Marital Status: Married drivers often enjoy lower rates compared to single individuals. Insurers tend to view married couples as more stable and less risky.

Understanding these factors can empower you to make informed decisions about your car insurance. For example, if you’re a young driver, you might want to consider taking a defensive driving course to improve your skills and potentially lower your rates.

Your choices can significantly influence your car insurance premiums in Utah. Consider how factors like your driving habits, vehicle selection, and even your credit history can affect your rates. By making informed decisions, you can potentially lower your insurance costs and find the best car insurance in Utah that fits your budget.

Strategies to Save on Car Insurance in Utah

While car insurance may be pricey in Utah, there are several strategies you can employ to help lower your premiums:

- Shop Around: Comparing quotes from multiple insurers is the best way to find the most competitive rates. With just a few clicks, you can now compare quotes from multiple insurers online, making it easier than ever to find the best deal. Don’t be afraid to switch providers if you find a better deal.

- Take Advantage of Discounts: Look for opportunities to save, such as bundling your auto policy with other insurance products, maintaining a clean driving record, or qualifying for good student or defensive driving discounts. Many insurers also offer discounts for low mileage or for vehicles equipped with safety features.

- Increase Your Deductible: Raising your deductible can significantly reduce your monthly premiums. However, make sure you have the financial means to cover the higher out-of-pocket costs in the event of a claim. This strategy works best for those who are confident in their driving abilities and have a good record.

- Improve Your Credit Score: Since Utah allows insurers to consider credit history, taking steps to improve your credit score can result in lower car insurance rates. Pay your bills on time, reduce debt, and check your credit report for errors.

- Consider Usage-Based Insurance: Telematics-powered programs that monitor your driving habits can reward safe driving with discounts. If you’re a cautious driver, this could be a great way to save money.

- Review Your Coverage Regularly: Life changes, such as getting married, moving, or buying a new car, can impact your insurance needs. Regularly reviewing your policy ensures you have the right coverage and can help you identify potential savings.

Additional Coverage Options to Consider

While meeting the state’s minimum insurance requirements is essential, many drivers in Utah opt for additional coverage to enhance their financial protection. Some optional coverage types to consider include:

- Collision Coverage: Protects your vehicle in the event of a collision with another car or a stationary object. This coverage is particularly important for newer or more valuable vehicles.

- Comprehensive Coverage: Covers damage to your car from non-collision events, such as theft, vandalism, or natural disasters. If you live in an area prone to such risks, this coverage can provide valuable peace of mind.

- Roadside Assistance: Provides help if your car breaks down, including towing, jump-starts, and lockout services. This coverage can be a lifesaver in emergencies and is often available as an add-on to your policy.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after a covered incident. This option can be particularly helpful if you rely on your vehicle for daily commuting.

These supplemental coverages can provide valuable peace of mind and safeguard your finances in the event of an unexpected accident or incident. Carefully evaluate your needs and budget to determine which additional coverage options are right for you.

Frequently Asked Questions

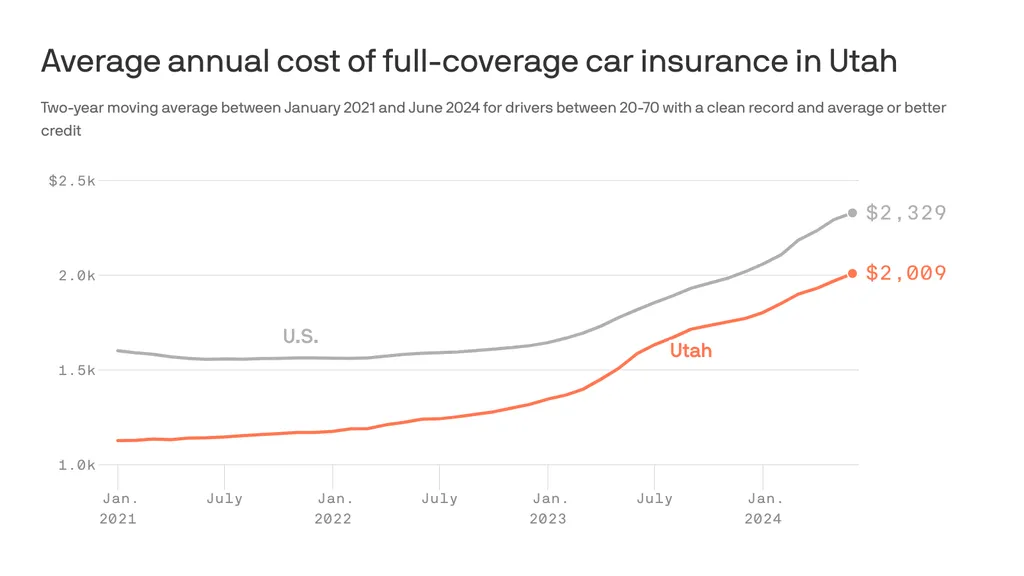

Q: What is the average cost of car insurance in Utah?

A: The average cost of full coverage car insurance in Utah is around $188 per month, while minimum coverage insurance can be more affordable, averaging around $82 per month. However, these are just statewide averages, and your actual rate will depend on your individual circumstances.

Q: What are some of the best car insurance companies for young drivers in Utah?

A: Companies like Farm Bureau and Auto-Owners often offer competitive rates for young drivers in Utah. They may have discounts available for good students or those who complete safe driving courses.

Q: How can I get a car insurance quote in Utah?

A: You can obtain quotes online by visiting the websites of different insurance companies. You can also contact an insurance agent or broker to get quotes and personalized advice.

Q: How often should I review my car insurance policy?

1. https://kinemasterap.org/mmoga-the-best-jewelry-insurance-protecting-your-engagement-ring-and-more

2. https://kinemasterap.org/mmoga-finding-the-best-pet-insurance-colorado-a-guide-for-pet-owners

5. https://kinemasterap.org/mmoga-best-auto-home-insurance-companies-save-money-simplify-coverage

A: It’s a good idea to review your car insurance policy at least once a year, or whenever there’s a significant change in your life, such as getting married, buying a new car, or moving to a new location. This will help ensure you’re getting the best coverage and rates for your current needs.

Comparing Car Insurance Options in Utah

When it comes to finding the best car insurance in Utah, it’s essential to understand how the different providers stack up against each other. Let’s take a closer look at some key comparisons:

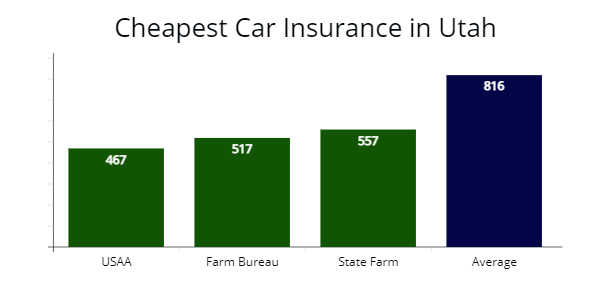

Cheapest Full Coverage Option

Based on our research, Auto-Owners Insurance offers the cheapest full coverage car insurance in Utah, with an average monthly cost of $114. This is $74 less than the state’s average of $188 per month. USAA also provides an affordable option at $104 per month, but this coverage is only available to military members and their families.

Cheapest Minimum Coverage Option

For drivers looking to meet the state’s minimum requirements, USAA stands out as the most affordable option at $43 per month. However, this coverage is limited to military personnel and their relatives. Auto-Owners Insurance comes in as the cheapest option for the general public, with an average minimum coverage cost of $51 per month.

Best for Young Drivers

Young drivers in Utah, particularly those under 25, face significantly higher insurance rates due to their lack of experience. Farm Bureau and Auto-Owners Insurance offer the most competitive rates in this category. For minimum coverage, Farm Bureau costs around $149 per month for an 18-year-old, while Auto-Owners’ full coverage option averages $376 per month.

By understanding the strengths and weaknesses of different insurance providers in Utah, you can make an informed decision and find the coverage that best suits your needs and budget.

Conclusion

When it comes to car insurance in Utah, there are many options available. By comparing rates and coverage from different providers, you can find the best deal for your specific needs. Remember to consider factors such as customer satisfaction, financial stability, and discounts offered when making your decision.

Ultimately, the most important thing is to have adequate coverage that protects you and your vehicle on the road. Don’t just settle for the cheapest option without considering all aspects of the policy. With proper research and understanding of your options, you can find affordable car insurance in Utah that meets your requirements and gives you peace of mind while driving.

Protecting Yourself Beyond the Basics: Exploring Optional Coverages

While meeting the minimum requirements is essential, considering additional coverage options can provide further financial security. Evaluate your lifestyle and driving habits to determine which optional coverages could enhance your protection.

Maximizing Your Car Insurance Protection in Utah

Whether you’re a new driver or a seasoned Utah resident, finding the best car insurance solution for your needs and budget is essential. By understanding the state’s unique requirements, comparing top-rated providers, and implementing strategic cost-saving measures, you can navigate the car insurance landscape with confidence and secure the coverage that will provide you with the protection and peace of mind you deserve.