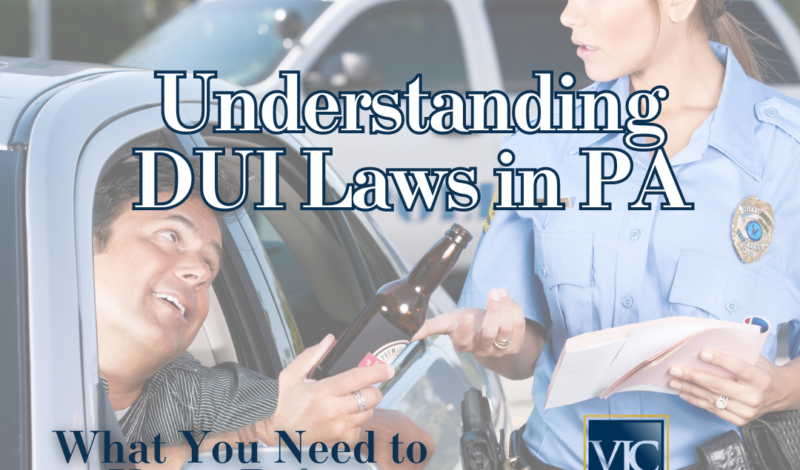

A DUI (Driving Under the Influence) conviction in Pennsylvania can significantly impact your car insurance rates. Finding the best insurance companies for car insurance after a DUI is crucial, as the state’s strict DUI laws often result in penalties ranging from fines and license suspension to potential jail time, depending on the severity of the offense.

Toc

- 1. Understanding the Impact of a DUI on Car Insurance in Pennsylvania

- 2. Best Insurance Companies for Car Insurance After a DUI in Pennsylvania

- 3. Tips for Finding Affordable Car Insurance After a DUI in Pennsylvania

- 4. Related articles:

- 5. Potential Discounts for DUI Drivers in Pennsylvania

- 6. Frequently Asked Questions (FAQ)

- 7. Conclusion

Understanding the Impact of a DUI on Car Insurance in Pennsylvania

The Severity of the DUI and Rate Increases

After a DUI, insurance companies will typically view you as a higher-risk driver, leading to substantial increases in your premiums, sometimes by as much as 50% or more. For example, a first-time DUI with a BAC of .08% might result in a 20% increase in premiums, while a repeat offender with a BAC over .10% and a related accident could see their rates rise by 50% or more.

Additionally, you’ll be required to obtain an SR-22 form, a certificate of financial responsibility that demonstrates you’re meeting the state’s minimum insurance requirements.

The SR-22 Form: What It Is and Why You Need It

The SR-22 is a certificate of financial responsibility that verifies you have the minimum required car insurance coverage, demonstrating that you can pay for any damages caused in an accident. It’s essentially a guarantee to the state that you’re financially responsible. Insurance companies file the SR-22 with the Pennsylvania Department of Transportation (PennDOT) on your behalf. You’ll need to maintain this coverage for a specific period, usually three years, after your DUI conviction.

The extent of the rate hike can vary depending on the insurance company and the details of your DUI case. Some insurers may be more willing to work with you, while others may see you as too high-risk and decline coverage altogether. Understanding how these factors influence your insurance rates is crucial for making informed decisions about your coverage options.

Best Insurance Companies for Car Insurance After a DUI in Pennsylvania

When searching for the best car insurance in Pennsylvania after a DUI, there are several reputable companies that stand out for their competitive rates and comprehensive coverage options.

Progressive

Progressive is known for offering some of the most affordable car insurance rates for drivers with a DUI in Pennsylvania. Their usage-based insurance program, Snapshot, can also help you potentially lower your rates by demonstrating safe driving habits. Progressive’s extensive coverage options and generally strong customer service ratings make them a solid choice for DUI drivers looking to get back on the road.

Pros:

- Competitive rates specifically for DUI drivers.

- The Snapshot program can reward safe driving with lower premiums.

- Comprehensive range of coverage options, including liability, collision, and comprehensive.

Cons:

- Rates may be higher than average for drivers with clean records.

- The potential for rate increases based on driving data collected through Snapshot.

Geico

As one of the largest auto insurers in the country, Geico is recognized for its competitive rates, including for drivers with a DUI in Pennsylvania. Their user-friendly online experience and straightforward quoting process make it easy to compare coverage options. While Geico may not offer as many discounts as some competitors, their overall affordability and digital capabilities make them a strong contender for DUI drivers.

Pros:

- Competitive rates for drivers with a DUI.

- Excellent online tools for easy quote comparisons and policy management.

- Comprehensive coverage options, including add-ons for enhanced protection.

Cons:

- May not have as many discount opportunities as other companies.

- Limited customization options for certain coverage types compared to competitors.

Erie Insurance

Erie Insurance is a regional provider with a strong focus on customer service and community involvement. While their rates may not be the absolute cheapest, Erie has a reputation for working with higher-risk drivers, including those with a DUI. Their coverage options and claims handling are generally well-regarded, and their local community presence can be an asset for Pennsylvania drivers.

Pros:

- Excellent customer service with a strong community presence.

- Potential for competitive rates in specific regions of Pennsylvania.

- A variety of coverage options tailored to individual needs.

Cons:

- Limited availability compared to larger national providers.

- Rates may not be as low as those offered by some competitors.

Beyond the Big Names: Exploring Other Options While Progressive, Geico, and Erie Insurance are prominent options, there are other reputable insurers in Pennsylvania that may offer competitive rates for DUI drivers. Consider researching companies like USAA (if you’re eligible due to military affiliation), State Farm, or Liberty Mutual, as they may have specialized programs or discounts for drivers with a DUI.

Tips for Finding Affordable Car Insurance After a DUI in Pennsylvania

While specific rates and coverage options will vary depending on the insurer, there are a few general tips that can help you find more affordable car insurance after a DUI conviction in Pennsylvania:

Shop Around

One of the most important steps in securing affordable car insurance after a DUI is to compare quotes from multiple insurers. Utilize online comparison tools and don’t hesitate to contact insurance agents directly to get personalized quotes. Working with an independent agent can be especially helpful, as they can provide quotes from a variety of providers.

Improve Your Driving Record

While a DUI will remain on your record for several years, you can take steps to demonstrate your commitment to safe driving and potentially lower your rates. Consider completing a defensive driving course, which may qualify you for a discount. Avoiding any additional traffic violations is also crucial, as it can further increase your insurance costs.

Consider Additional Coverage

Even with higher rates, it’s important to ensure you have adequate insurance coverage. While the minimum liability coverage required in Pennsylvania may be tempting, consider adding optional coverage like uninsured motorist protection and comprehensive/collision insurance to protect your vehicle. This can provide an extra layer of financial protection, even if your overall premiums are higher.

Maintain Financial Responsibility

A DUI conviction can have far-reaching financial consequences, including increased insurance costs, fines, and potential legal fees. It’s crucial to develop a budget and seek out any available resources or support programs to help you manage these expenses and stay financially responsible. Consider setting aside a specific amount each month to cover potential increases in your insurance premiums. This proactive approach can help you avoid financial strain while ensuring you have the necessary coverage in place.

The Importance of Disclosure

When it comes to car insurance, honesty is crucial. It’s essential to be upfront with your insurance company about your DUI conviction. Concealing this information can lead to policy cancellation and other legal issues. By being honest, you may be able to find an insurer willing to work with you and provide the best coverage options at the most competitive rates possible. Additionally, if you fail to disclose your DUI and are involved in an accident, your insurance may not cover the damages and you could face serious legal consequences. Always be transparent with your insurer to ensure you have proper coverage and avoid any potential complications down the line.

Potential Discounts for DUI Drivers in Pennsylvania

Despite the challenges of finding affordable car insurance after a DUI, there are still opportunities to save money. Many insurers offer a range of discounts that can help offset the higher rates, such as:

Defensive Driving Course Discount

Completing a defensive driving course can not only enhance your driving skills but also make you eligible for a discount on your insurance premiums. These courses cover a variety of topics, such as how to handle emergencies, the importance of seatbelt use, and strategies for maintaining safe distances from other vehicles. Be sure to check with your insurance provider to see if they recognize particular defensive driving courses and the amount of discount you can expect.

Multi-Policy Discount

Bundling multiple insurance policies with the same provider can also lead to significant savings. For instance, if you have homeowners or renters insurance, consider getting your auto insurance from the same company. Many insurers offer multi-policy discounts, which can help lower your overall insurance costs. This not only simplifies your insurance management but also maximizes your chances of obtaining more discounts.

Payment Discounts

Another way to reduce your premium costs is by paying your insurance premium in full upfront or setting up automatic monthly payments. Many insurers offer discounts for policyholders who choose these payment options. Paying in full can often yield a more substantial discount, but automatic payments are also a convenient way to ensure you never miss a payment, which helps maintain your coverage and avoid late fees.

Low Mileage Discount

If you drive less frequently, you may be eligible for a low mileage discount. Insurers recognize that less time on the road reduces the risk of accidents, and some offer lower rates for drivers who log fewer miles each year. Be sure to report your mileage accurately and ask your insurer if they provide discounts for limited driving.

Good Student Discount

For younger drivers with a DUI on their record, maintaining good grades can be an incentive for discounts. Many insurance companies offer discounts to students who achieve a certain grade point average. If you’re in school and have a DUI conviction, focus on your academics as a way to help lower your insurance costs.

Frequently Asked Questions (FAQ)

Q: What is an SR-22 form, and why do I need it?

A: An SR-22 is a certificate of financial responsibility that is mandated in Pennsylvania following a DUI conviction. This document serves as proof that you are carrying the minimum required liability insurance coverage as mandated by state law. Your insurance company is responsible for filing the SR-22 with the Pennsylvania Department of Transportation (PennDOT) on your behalf. It’s important to keep this certificate active, as failure to do so can lead to license suspension.

Q: How long will my DUI affect my insurance rates?

A: The impact of a DUI on your insurance rates can vary significantly depending on the specific insurance company you are with and the severity of the offense. Generally, you can expect that a DUI will lead to higher premiums that may persist for several years. While some insurers might raise your rates immediately after a conviction, others may review your driving record at renewal time, and it typically takes three to five years for rates to return to normal levels, provided you maintain a clean driving history during that time.

Q: Can I get car insurance if I have multiple DUIs?

A: Yes, you can still obtain car insurance if you have multiple DUIs, but it may prove to be quite challenging. Insurance providers often consider individuals with multiple DUIs to be high-risk drivers, which means finding coverage may be more difficult, and the rates will likely be significantly higher than average. You may need to reach out to specialized insurers who focus on providing coverage for high-risk drivers or look into non-standard insurance options which are designed for those with less-than-perfect driving records.

Q: What can I do to lower my insurance rates after a DUI?

A: Lowering your insurance rates after a DUI can be challenging but is achievable with some proactive steps. First, consider enrolling in a defensive driving course; many insurers offer discounts for drivers who complete such programs since they demonstrate a commitment to safe driving. Additionally, maintaining a clean driving record free from further violations will eventually help in reducing your rates. It’s also beneficial to shop around for quotes from different insurance providers, as rates can vary widely. Finally, don’t hesitate to inquire about any discounts your insurer may offer, such as bundling policies or discounts for having certain safety features in your vehicle.

Conclusion

Finding the best car insurance in Pennsylvania after a DUI can be a challenging task, but it’s not an impossible one. By understanding your options, comparing quotes from multiple insurers, and taking steps to improve your driving record, you can secure competitive coverage. Remember to be upfront with insurance companies about your DUI, as this is essential for finding the best rates and protection. Start your search today and don’t hesitate to ask questions to find the right car insurance company for your needs. With the right approach, you can get back on the road with the coverage you need.